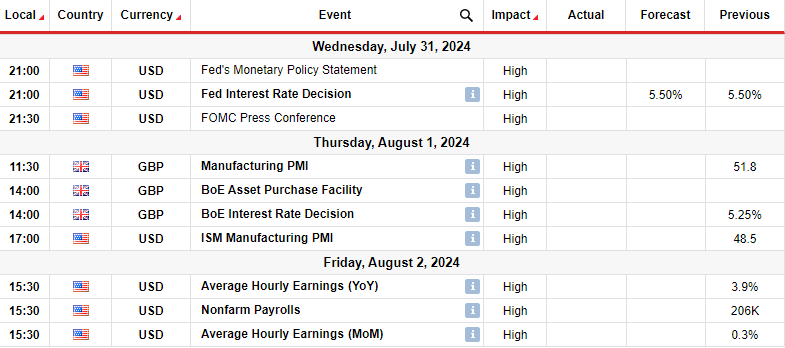

- Buyers are totally anticipating two charge cuts from the BoE by December.

- Information on US and UK enterprise exercise confirmed additional enlargement in June.

- Buyers can pay shut consideration to financial coverage conferences within the US and the UK.

The GBP/USD weekly forecast is trending south as markets shift in the direction of a extra dovish outlook for the Financial institution of England.

Ups and downs of GBP/USD

The GBP/USD value fell final week as Financial institution of England charge lower expectations elevated. On the similar time, the greenback firmed as knowledge confirmed financial resilience and easing inflation. Buyers are totally anticipating two charge cuts from the BoE by December. Nevertheless, the timing stays unclear. Price lower bets went up as bets for a September Fed lower rose.

–Are you interested by studying extra about Forex robots? Examine our detailed guide-

In the meantime, knowledge on enterprise exercise from the US and the UK confirmed additional enlargement in June. Due to this fact, each economies are doing properly regardless of excessive charges. Further US knowledge revealed bigger-than-expected financial development in Q2 and a drop in unemployment claims. The week ended with inflation figures coming in as anticipated at 0.2%.

Subsequent week’s key occasions for GBP/USD

Subsequent week, buyers can pay shut consideration to financial coverage conferences within the US and the UK. The Fed will meet on Wednesday and sure hold rates of interest unchanged at 5.50%. In the meantime, the Financial institution of England will meet on Thursday, and there’s a 50% probability policymakers will vote to decrease borrowing prices.

Moreover, markets will give attention to the all-important US month-to-month employment report. The final report confirmed slower job development and a rise within the unemployment charge. If this development continues, policymakers would possibly assume a extra dovish tone. On the similar time, the greenback would fall, permitting GBP/USD to rally.

GBP/USD weekly technical forecast: Bears problem bullish development on the 22-SMA

On the technical aspect, the GBP/USD value has fallen again to the 22-SMA after reaching new highs. Nevertheless, the bullish bias stays intact, with the value above the SMA and the RSI barely above 50. The bullish development continued when the value broke above the 1.2800 key resistance degree.

–Are you interested by studying extra about XRP price prediction? Examine our detailed guide-

Bears prompted a pullback earlier than the value reached the 1.3050 key degree. If the bullish development stays in play, the value will bounce off the 22-SMA to revisit the 1.3050 resistance. Nevertheless, if bears take over, it would break beneath the SMA and the 1.2800 help.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash.