- Knowledge on Tuesday confirmed upbeat US retail gross sales, indicating resilience.

- Canada’s inflation eased greater than anticipated, boosting bets for a July charge lower.

- The Financial institution of Canada will probably lower charges subsequent week.

The USD/CAD weekly forecast paints a powerful bullish image because the Canadian greenback plummets amid poor knowledge and a looming BoC charge lower.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week because the US greenback soared in opposition to a weak Canadian greenback. Though the greenback was weak within the broader market, the loonie was weaker. Knowledge on Tuesday confirmed upbeat US retail gross sales, indicating resilience. In the meantime, inflation eased greater than anticipated in Canada, boosting bets for a July charge lower.

–Are you curious about studying extra about Forex indicators? Verify our detailed guide-

To make issues worse, Canada reported dismal gross sales on Friday, nicely beneath expectations. This clearly confirmed that the financial system is falling aside as a consequence of excessive charges. Consequently, the Financial institution of Canada has each purpose to decrease borrowing prices.

Subsequent week’s key occasions for USD/CAD

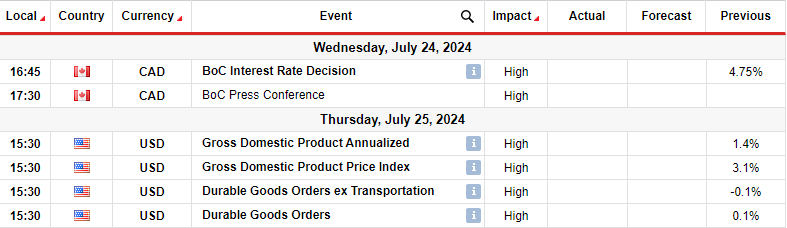

Buyers will give attention to the Financial institution of Canada coverage assembly subsequent week. In the meantime, stories on GDP and sturdy items within the US might be launched.

The Financial institution of Canada will probably lower charges subsequent week after inflation eased additional in June. The probabilities of a lower in July rose sharply after knowledge this week confirmed that inflation in Canada elevated by a smaller-than-expected 2.7%. This got here after a leap of two.9% in Could. On the similar time, economists count on the central financial institution to chop twice extra in 2024.

In the meantime, US GDP knowledge will present the state of the financial system. Nonetheless, until a giant shock exists, it won’t change the outlook for a lower in September.

USD/CAD weekly technical forecast: Bulls cost for vary resistance degree

On the technical aspect, the USD/CAD value trades above the 22-SMA, with the RSI rising above 50, exhibiting that bulls are in management. Nonetheless, the worth has been buying and selling sideways, chopping via the SMA. Subsequently, bears and bulls are equally matched, and the market has no clear path.

–Are you curious about studying extra about Best Bitcoin Exchanges? Verify our detailed guide-

Notably, the worth has stayed in a spread between the 1.3600 assist and the 1.3750 resistance. Subsequently, the worth should escape of this space to start out trending. Since bulls are in cost, the worth may problem the vary resistance. A break above would permit the worth to revisit the 1.3900 key degree. Nonetheless, if the worth fails to interrupt above, it would proceed consolidating.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you possibly can afford to take the excessive danger of shedding your cash.

Leave a Reply