Yesterday, the US CPI was a pleasant quantity because it got here in decrease than expectations. In the present day, the PPI knowledge was the precise reverse. The headline numbers for the month weren’t solely larger, however the prior months had been revised larger as nicely.

The USD and yields transfer larger initially after the report, however the reminiscence of the Chair feedback this week the place he talked about decrease inflation and the way it is not nearly inflation but additionally the employment image, together with the CPI knowledge, despatched yields and the greenback again to the draw back.

Later at 10 AM the Michigan shopper confidence stayed close to low ranges (and beneath expectations) after the sharp, shocking drop from final month.

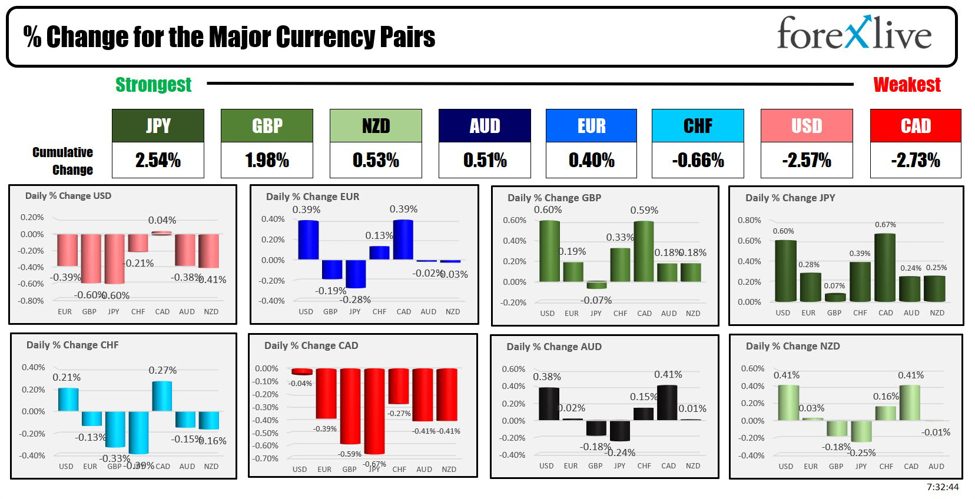

All of which helped to ship the buck decrease vs all the foremost currencies as we speak. On the finish of the day, the USD was unchanged vs the CAD, however fell by -0.21% vs the CHF and had declines of -0.38% to -0.60% vs the opposite main indices (the USD fell -0.60% vs each the GBP and the JPY).

For the buying and selling week the USD is ending principally decrease with solely rising modesly vs the NZD. The bucks adjustments for the week vs the majors confirmed:

- EUR, -0.61%

- GBP, -1.35%

- JPY, -1.78%

- CHF, -0.08%

- CAD, -0.035%

- AUD, -0.53%

- NZD +0.43%

Trying on the US debt market as we speak, the yields moved decrease with the 2-year the most important decliner. The yield spreads proceed to chip away on the unfavourable yield curve as we speak:

- 2 yr yield 4.457%, -4.9 foundation factors. For the week, the yield fell -15.4 foundation factors.

- 5 yr yield 4.107%, -1.6 foundation factors. For the week, the yield fell -12.3 foundation factors.

- 10 yr yield 4.186%, -0.6 foundation factors. For the week, the yield fell -9.5 foundation factors.

- 30 yr yield 4.398%, -0.5 foundation factors. For the week, the yield fell -8.1 foundation factors

Trying on the spreads:

- 2-10 yr unfold, -27.1 foundation factors which is the least unfavourable shut since January. For the week, the unfold rose 5.7 foundation factors.

- 2-30 yr unfold, -5.9 foundation factors which is the least unfavourable shut additionally because the finish of January. The unfold rose by 7 foundation factors this week.

Along with decrease CPI, the yields had been helped by beneficial 3 and 10 yr observe auctions (met by robust home demand). The 30 yr bond was a special story, however 2 out of three outweighed probably the most troublesome 30 yr public sale.

In different markets:

- Crude oil this week fell -1.14% to $82.21.

- Gold rose $19.54 or 0.82% to $2410.78

- Silver rose fell by -$0.47 or -1.38% to $30.77

- Bitcoin rose by $1778 to $57617

Subsequent week,

Monday:

- Empire manufacturing

- Fed Chair Powell at 12 PM ET

Tuesday

- Canada CPI

- US Retail Gross sales

- NZD CPI at 6:45 PME ET

Wednesday:

- UK CPI

- Austalia employment knowledge 9:30 PM ET

Thursday:

- UK employment

- ECB fee resolution (no change anticipated)

- US weekly jobless claims

- Philly Fed Manufacturing

Friday

- UK Retail Gross sales

- Canada Retail Gross sales.

The key earnings releases for the week embrace:

Monday, July 15

- Goldman Sachs, BlackRock,

Tuesday, July 16

- Financial institution of America.United well being group.Progressive.Morgan Stanley..Charles Schwab..PNC.Interactive Brokers. JB Hunt,

Wednesday, July 17

- Johnson & Johnson,United,Alcoa,Uncover,Kinder Morgan

Thursday, July 18

- Taiwan Semi Conductor,Nokia,DR Horton,Netflix,Intuitive Surgical,PPG

Friday, July 19

- American Categorical,Halliburton,,Comerica,Vacationers

When are the Magnificent 7 releasing its earnings this cycle?

- Alphabet, July 23

- Microsoft July 23

- Tesla July 23

- Amazon, July 25

- Meta Platforms, July 31

- Apple, August 1

- Nvidia, August 15