After the US jobs report final week, the massive image focus in markets is now on main central financial institution choices. Particularly, the Fed subsequent week would be the most anticipated one. The chances for a 50 bps fee reduce are actually at ~29% and down from roughly a coin flip at one level final week. The Fed blackout interval has begun, so it will be secure to imagine that policymakers are snug with a 25 bps transfer at this stage.

The greenback is retaining steadier as such, with some calm permeating again by way of markets. The overblown fears surrounding the US labour market are ebbing, so that’s maybe serving to. That alongside the Fed’s personal calm manner I might say.

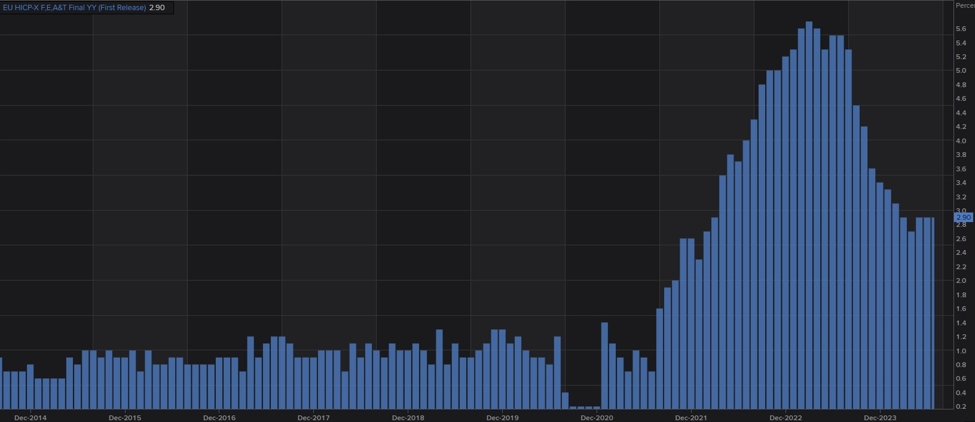

That may make for a little bit of a pensive week as we await the FOMC assembly subsequent week. The ECB is on the agenda on Thursday however there should not be any fireworks. A 25 bps fee reduce is nicely orchestrated already. Apart from that, we could have the newest US CPI report tomorrow. However hey, what’s inflation information lately?

Seeking to the session forward, we do have UK labour market information to work with. However once more, there’s a giant caveat hooked up to the info as seen final month here. So, I would not put an excessive amount of emphasis into it. Aside from that, there’ll simply be some gentle information to maneuver issues alongside on the day.

0600 GMT – Germany August remaining CPI figures

0600 GMT – UK July ILO unemployment fee, employment change

0600 GMT – UK July common weekly earnings

0600 GMT – UK August payrolls change

1000 GMT – US August NFIB small enterprise optimism index

That is all for the session forward. I want you all the very best of days to return and good luck together with your buying and selling! Keep secure on the market.