- The US greenback has recovered for the reason that earlier session as Israel and Hezbollah exchanged missiles.

- The Fed chair opened the door to a price minimize in September.

- BoJ Governor Kazuo Ueda maintained a hawkish tone on Friday.

The USD/JPY value evaluation is barely bullish as traders steadiness a stronger greenback and yen amid safe-haven demand. Over the weekend, an escalation in Center East tensions pushed traders to purchase safe-haven belongings just like the greenback and the yen. Nevertheless, buying and selling was skinny as UK markets closed for a public vacation.

-Are you curious about studying about forex live calendar? Click on right here for details-

Notably, the US greenback has recovered for the reason that earlier session as Israel and Hezbollah exchanged missiles. Tensions have remained excessive for the reason that demise of senior leaders within the battle. Furthermore, the probabilities of a ceasefire settlement between Israel and Gaza have fallen, elevating fears of a extra extended battle that might broaden.

The safe-haven inflows to the greenback reversed final week’s decline after Powell’s speech. Notably, the Fed chair opened the door to a price minimize in September, weakening the greenback. Fed policymakers are extra assured value stress will ease to the two% goal. On the identical time, they’re changing into weary of a weak labor market. Consequently, the probability of a price minimize in September has risen.

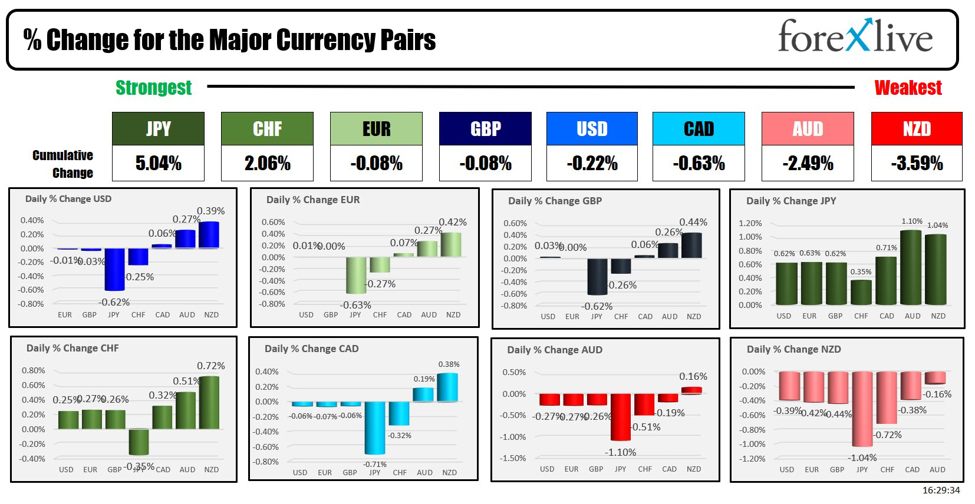

In the meantime, BoJ Governor Kazuo Ueda maintained a hawkish tone on Friday. The tone distinction between the 2 high policymakers has created a divergence in coverage outlooks. Traders count on decrease charges within the US and better charges in Japan. This divergence boosted the yen, elevating the prospect of a smaller price hole between Japan and the US.

Traders at the moment are awaiting the US core PCE value index for extra clues on the timing and measurement of future Fed price cuts.

USD/JPY key occasions in the present day

- US CB shopper confidence

USD/JPY technical value evaluation: Corrective transfer meets SMA resistance

On the technical facet, the USD/JPY value has risen to retest the 30-SMA resistance after a pointy decline. Nevertheless, the bearish bias stays intact, and the value will seemingly respect the SMA as resistance. Notably, the bullish transfer was weak and shallow, indicating a correction.

-Are you curious about studying about forex signals? Click on right here for details-

Due to this fact, if bears stay in management, the value would possibly bounce decrease with an impulsive transfer to retest the 142.50 assist degree. Right here, bears will meet a stable barrier. A break beneath will solidify the bearish bias. Nevertheless, if the assist holds agency, USD/JPY will consolidate or bounce greater.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive threat of shedding your cash