- The US manufacturing PMI fell from 48.5 in June to 46.8 in July.

- US jobs development eased in July.

- The greenback remained sturdy as a result of safe-haven demand.

The USD/CAD weekly forecast is bullish because the greenback climbs amid elevated geopolitical tensions and financial uncertainties. Nevertheless, Friday’s downbeat US NFP erased some weekly good points.

Ups and downs of USD/CAD

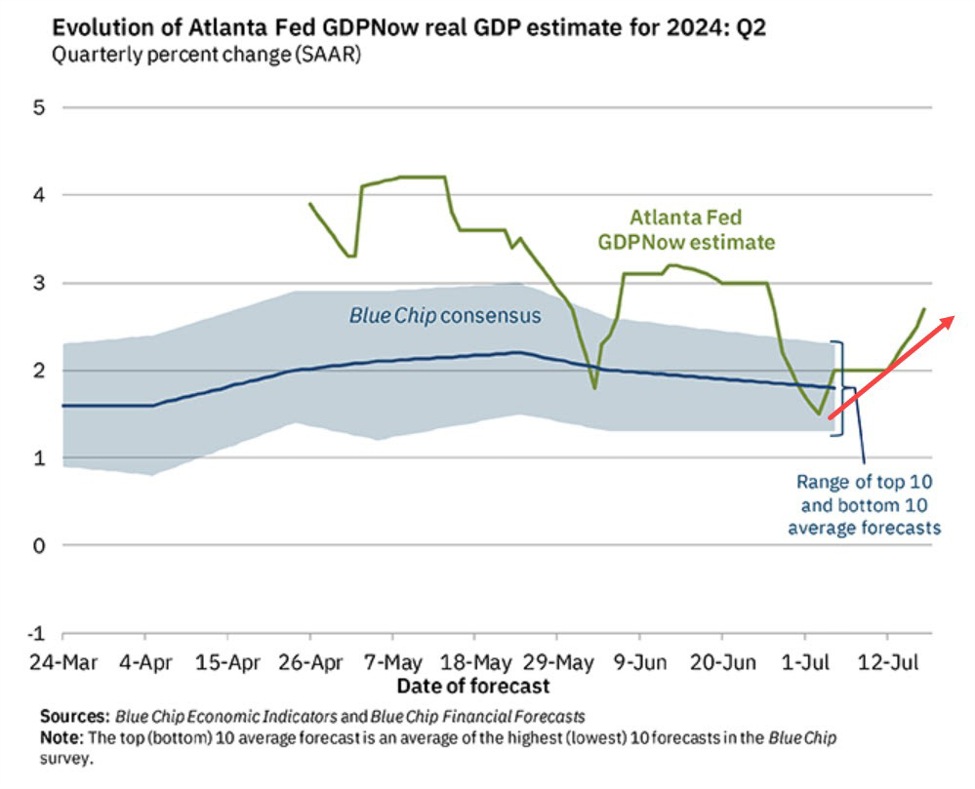

The loonie had a bullish week regardless of weaker-than-expected US knowledge. On the similar time, the Fed took on a extra dovish tone on the assembly on Wednesday. Notably, the US manufacturing PMI fell from 48.5 in June to 46.8 in July. Consequently, there have been fears that the economic system was slowing down at a quick charge.

-Are you in search of automated trading? Verify our detailed guide-

In the meantime, US jobs development eased in July, with the unemployment charge spiking to 4.3%. Within the final week, Fed charge minimize bets soared, and policymakers opened the door to a September minimize. Nevertheless, the greenback remained sturdy as a result of safe-haven demand. Center East tensions elevated with the killing of a Hamas chief, pushing buyers to purchase the greenback.

Subsequent week’s key occasions for USD/CAD

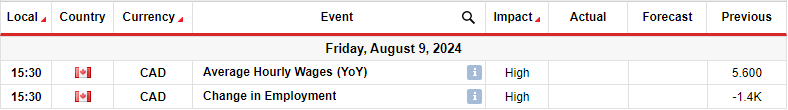

Subsequent week, Canada will launch its month-to-month employment figures, shaping the outlook for charge cuts. Final month’s report confirmed a pointy slowdown within the labor market that raised fears of additional financial deterioration. Canada misplaced 1,400 jobs when economists had forecasted a rise. These figures elevated strain on the Financial institution of Canada to chop charges. Consequently, buyers guess closely on charge cuts, weighing on the Canadian greenback.

On the July assembly, the BoC minimize charges and took on a extra dovish outlook. Economists anticipate one other charge minimize on the September assembly. Due to this fact, if the employment report reveals additional weak point, the September charge minimize bets will rise. However, if employment recovers, there might be much less strain on Canada’s central financial institution to chop charges.

USD/CAD weekly technical forecast: Strong bullish swing

On the technical facet, the USD/CAD value has damaged above the 1.3802 resistance stage to make the next excessive. The break comes after a pointy bullish transfer from the 1.3601 assist stage. Initially, bears and bulls had been equally matched. The worth made sturdy bearish, and bullish candles.

-In case you are concerned about forex day trading then have a learn of our information to getting started-

Nevertheless, the final swing had solely bullish candles, indicating one facet was stronger. Consequently, the worth simply breached the 1.3802 resistance stage. It retested the 1.3802 stage as assist to substantiate the break earlier than making the next excessive. This means a brand new bullish development that may proceed subsequent week, with a break above the 1.3901 key stage.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive threat of dropping your cash.