- The greenback fell as a result of renewed bets for a 50 bps September Fed price reduce.

- A number of Financial institution of Japan policymakers drummed up assist for extra price hikes.

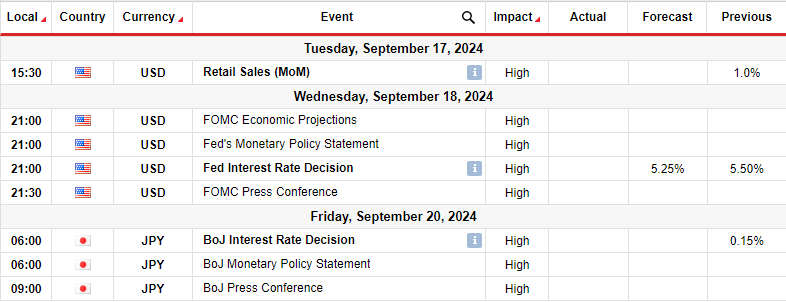

- Traders will concentrate on the FOMC and BoJ coverage conferences.

The USD/JPY weekly forecast signifies a possible collapse if the Fed cuts by 50-bps and the Financial institution of Japan delivers a hawkish assembly.

Ups and downs of USD/JPY

USD/JPY has fallen and closed on a bearish candle previously week. This got here because the greenback collapsed whereas the yen strengthened. The greenback fell as a result of renewed bets for a 50 bps price reduce in direction of the top of the week. Initially, inflation stories had pointed to a smaller reduce.

–Are you curious about studying extra about STP brokers? Verify our detailed guide-

Then again, the yen rallied as a number of Financial institution of Japan policymakers drummed up assist for extra price hikes.

Subsequent week’s key occasions for USD/JPY

Subsequent week, traders will concentrate on the FOMC coverage assembly and retail gross sales information from the US. On the identical time, the Financial institution of Japan will maintain its coverage assembly on Friday. Traders have waited for the September Fed assembly for a very long time. The Fed will possible pivot at this assembly, implementing its first price reduce.

Nevertheless, traders are uncertain whether or not this will likely be 25 or 50 bps. A small price reduce may increase the greenback as it might precede a gradual tempo for relieving. Then again, a big price reduce would sink the dollar.

In the meantime, the Financial institution of Japan would possibly preserve charges for now. Nevertheless, economists are pricing one other price hike earlier than the yr ends.

USD/JPY weekly technical forecast: Bullish divergence close to 140.07

On the technical aspect, the USD/JPY value has made a brand new low within the downtrend after breaking under the 144.00 assist degree. Bears have remained in cost because the value broke under the 22/SMA, and the RSI dipped under 50. Since then, the value has declined steeply and paused close to the 140.07 assist degree.

–Are you curious about studying extra about forex robots? Verify our detailed guide-

Nevertheless, bears have weakened with time, and the value began consolidating close to the 22-SMA. On the identical time, the RSI has made a bullish divergence, indicating fading bearish momentum. Due to this fact, the tides would possibly quickly change. If bears fail to breach the 140.07 assist, the value would possibly reverse to problem the 22-SMA and the 144.00 degree.

A break above the SMA would point out a shift in sentiment. Then again, if the SMA holds agency, the downtrend would possibly proceed.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash