Markets:

- Gold down $20 to $2496

- US 10-year yields down 1.4 bps to three.72%, 2-year yields down 9.3 bps to three.65%

- WTI crude oil down $1.07 to $68.08

- S&P 500 down 1.7%

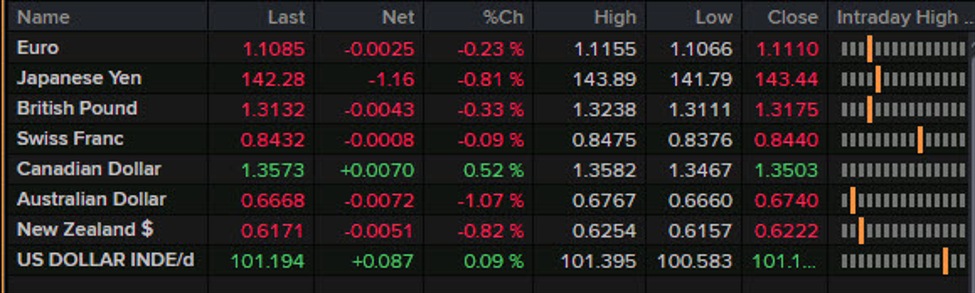

- JPY leads, AUD lags

Non-farm payrolls Friday lived as much as the hype, although it wasn’t precisely easy. The kneejerk response to the report was dovish and the US greenback bought off considerably as 50 bps reduce odds rose to 57%. In that transfer the euro rose to 1.1154 from 1.1105 and the pound rose 60 pips to 1.3240.

It took about an hour for these strikes to fade utterly because the market took a second have a look at the roles report and began having questions on whether or not the headline miss and revisions had been sufficient to make up for a barely improved unemployment price. The retracement was compounded by Williams, who supplied little in the best way of a push for 50 bps, as a substitute taking part in it protected.

The following massive transfer got here with the Fed’s Waller. Initially the market latched onto his discuss entrance loading cuts:

I can be an advocate of front-loading price cuts if that’s acceptable.

Nonetheless the market then took a have a look at the totality of the speech and notably a line saying the “labor market is softening however not deteriorating.” That led to a drop in 50 bps reduce odds to 23%.

However there may be at all times reflexivness in markets and that, in flip, triggered a rout in shares and a flight to security in bonds. That is a basic case of market kicking-and-screaming that pushed 50 bps odds again as much as 31%. For his half, Timiraos weighed in on the 25 bps facet however I actually would not take that as a leak, although it in all probability moved markets.

The key volatility within the day got here in USD/JPY, which ranged from 141.79 to 143.89 and finally completed about 50 pips from the lows. However there have been 5 touches on both facet of that vary because the remarkably-volatile buying and selling continues. Eyes can be on Japan on the open on Monday after a troublesome week for the Nikkei.

The US jobs report wasn’t the one one launched as Canadian unemployment ticked as much as 6.6% from 6.4% and is now two share factors above the lows. The shortage of fifty bps from the BOC this week is a hard signal of central banks which can be behind the curve and an in depth in brent on the lowest since 2021 actually would not assist the loonie’s case.

Leave a Reply