- The Canadian greenback strengthened as a consequence of a rally in oil costs.

- US shopper confidence soared and the economic system expanded at a faster-than-expected price.

- Canada’s economic system confirmed no growth, lacking expectations for a 0.1% development.

The USD/CAD weekly forecast leans bullish amid financial divergence between Canada and the US. Correcting oil costs might additionally weigh on the loonie.

Ups and downs of USD/CAD

The USD/CAD pair fell this week however closed effectively above its lows. The decline got here because the Canadian greenback strengthened as a consequence of a rally in oil costs. Oil soared amid elevated tensions within the Center East.

–Are you to be taught extra about day trading brokers? Test our detailed guide-

Nevertheless, financial information from the US and Canada supported an uptrend. Notably, US shopper confidence soared, and the economic system expanded at a faster-than-expected price. On the identical time, the core PCE value index held regular at 0.2%. These studies supported a robust greenback.

Alternatively, Canada’s economic system confirmed no growth, lacking expectations for a 0.1% development. Consequently, the Canadian greenback eased.

Subsequent week’s key occasions for USD/CAD

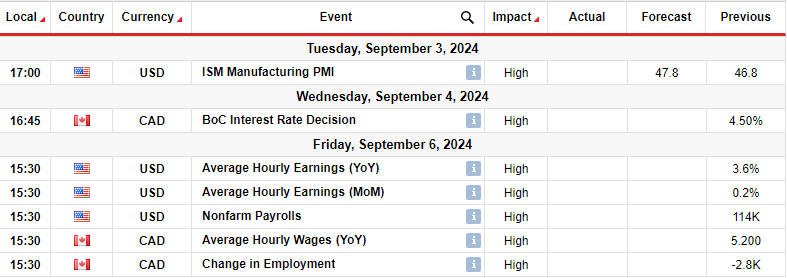

Subsequent week, the US will launch manufacturing PMI and employment information. Equally, Canada will launch its employment report. Moreover, buyers will watch the Financial institution of Canada coverage assembly on Wednesday.

The employment figures in each nations will form the outlook for future coverage selections by the Fed and the BoC. Central banks are beginning to focus extra on development as inflation nears targets. Subsequently, policymakers are eager to see whether or not demand within the labor sector is falling. Notably, the labor market drives an enormous a part of most economies. Consequently, indicators of weak point will strain central banks to decrease borrowing prices.

In the meantime, buyers predict one other price lower when the BoC meets.

USD/CAD weekly technical forecast: Sharp decline pauses with 1.3400 in sight

On the technical aspect, the USD/CAD value has continued its decline beneath the 1.3600 crucial degree, indicating a stable bearish bias. The value trades far beneath the 22-SMA, and the RSI is close to the oversold area, exhibiting that bears are within the lead.

–Are you to be taught extra about automated trading? Test our detailed guide-

Nevertheless, the decline paused earlier than reaching the subsequent help degree at 1.3400. This is an indication that bears are exhausted after such a steep decline. Subsequently, they want a brief break earlier than persevering with decrease. A pullback might revisit the 1.3600 degree or the 22-SMA. Nonetheless, for the reason that bearish bias is powerful, the worth would possibly ultimately fall to the 1.3400 help degree.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must take into account whether or not you possibly can afford to take the excessive danger of shedding your cash.