- Gold value consolidates after final week’s fee minimize rally.

- If the US PCE figures miss forecasts, traders will count on a extra dovish Fed.

- Center East rigidity supported gold on Thursday.

The gold outlook is bullish as traders await extra US inflation knowledge for clues on the scale and tempo of Fed fee cuts. Regardless of transient pullbacks, gold’s bullish development has remained as a result of rate-cut optimism and safe-haven demand.

-Are you curious about studying about forex live calendar? Click on right here for details-

Spot gold fell on Wednesday because the greenback strengthened amid hypothesis earlier than Friday’s inflation figures. Costs have fluctuated this week, consolidating after final week’s fee minimize rally. On Friday, Powell mentioned it was time for the Fed to pivot and decrease rates of interest. In consequence, traders elevated bets for a September fee minimize, pushing Treasury yields decrease. In the meantime, gold, a non-yielding asset, rallied.

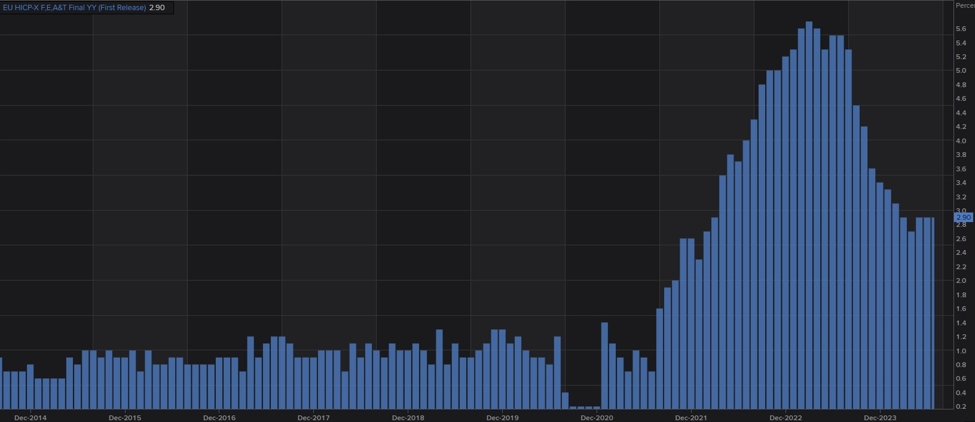

Nevertheless, this week, there was a mixture of fee minimize optimism, warning forward of information, and geopolitical tensions. Warning has pushed most traders to take earnings forward of Friday’s PCE value index report. On the identical time, costs have bounced larger on the probability of additional proof that inflation is declining.

If the PCE figures miss forecasts, traders will count on a extra dovish Fed. Consequently, the XAU/USD value will rally. However, if inflation meets forecasts or is available in barely larger, gold would possibly ease briefly. Market contributors are totally anticipating a fee minimize and it’ll take rather a lot to alter this outlook. Subsequently, there’s seemingly extra upside potential for gold.

In the meantime, Center East rigidity supported gold on Thursday because the conflict in Gaza intensified. Israel engaged in missile wars with Hezbollah which have raised fears of escalation. Consequently, traders have purchased extra safe-haven property like gold.

Gold key occasions right now

- Prelim US GDP q/q

- US unemployment claims

Gold technical outlook: Bulls retest 2520.09 resistance

On the technical aspect, the XAU/USD value is retesting the 2520.09 stable resistance degree. The bias is bullish for the reason that value trades above the 30-SMA with the RSI over 50. On the identical time, the value has made a collection of upper highs and lows, indicating a developed bullish development.

-Are you curious about studying about forex signals? Click on right here for details-

The development paused and began consolidating with help at 2480.38 and resistance at 2520.09. Nevertheless, bulls remained stronger for the reason that value revered its bullish trendline. Consequently, it would quickly breach the vary resistance to make a brand new excessive.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you’ll be able to afford to take the excessive threat of shedding your cash.