Elementary

Overview

The Nasdaq lastly erased your entire drop from the final ISM

Manufacturing PMI because the market pale the “progress scare”. The primary catalyst

was the great US

Jobless Claims on the 8th of August as that quelled the fears on

a deteriorating labour market triggered by the weak NFP

report.

Final week, we bought even higher Jobless

Claims figures and an excellent Retail

Sales report which elevated the bullish momentum. The market’s focus is

now clearly on progress. This week, we can have two key occasions.

The primary shall be on Thursday as we are going to get the discharge of the US Flash

PMIs for August and that shall be type of a check for the thesis that the July

information was negatively affected by Hurricane Beryl. The second shall be Fed

Chair Powell’s speech on the Jackson Gap Symposium the place he’ll doubtless

pre-commit to a charge lower in September.

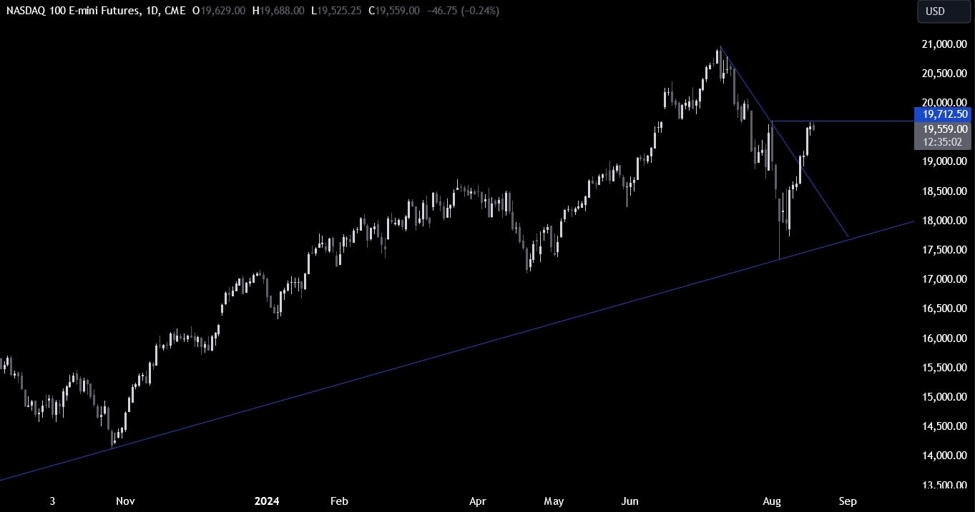

Nasdaq

Technical Evaluation – Day by day Timeframe

Nasdaq Day by day

On the day by day chart, we will

see that the Nasdaq broke above the important thing trendline and prolonged the features into the important thing

19712 degree. That is the place we will count on the sellers to step in with an outlined

threat above the extent to place for a drop into the main trendline across the

18000 degree. The consumers, then again, will wish to see the value breaking

greater to extend the bullish bets into new highs.

Nasdaq Technical

Evaluation – 4 hour Timeframe

Nasdaq 4 hour

On the 4 hour chart, we will

see that we an upward trendline defining the present bullish momentum. If we

have been to get an even bigger pullback, the consumers will doubtless lean on the trendline

the place they can even discover the 38.2% Fibonacci

retracement degree for confluence.

The sellers, then again, will wish to see the value breaking decrease to

improve the bearish bets into the 18000 degree.

Nasdaq Technical

Evaluation – 1 hour Timeframe

Nasdaq 1 hour

On the 1 hour chart, we will

see that we’ve a steeper minor upward trendline that’s been appearing as help

for the consumers as they saved on leaning on it to push into greater highs. That is

the place we are going to doubtless see them stepping in once more with an outlined threat beneath the

final greater low at 19445 to place for a break above the important thing resistance.

The sellers, on the opposite

hand, will wish to see the value breaking beneath the trendline and the 19445

degree to extend the bearish bets into the opposite trendline across the 19000

degree. The purple strains outline the average daily range for in the present day.

Upcoming Catalysts

Today we’ve Fed’s Waller talking. On Thursday we get the US Jobless Claims

figures and the US PMIs. On Friday we conclude with Fed Chair Powell talking

on the Jackson Gap Symposium.