- Knowledge revealed that July’s US wholesale inflation was softer than anticipated.

- The headline US CPI determine eased to 2.9% from 3.0%.

- The greenback bought a short respite when retail gross sales jumped by 1.0%.

The USD/CAD weekly forecast leans bearish amid rising confidence in a quarter-point September Fed fee reduce.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week, with US knowledge as the first catalyst. Most US financial experiences weighed on the greenback in the course of the week, strengthening the Canadian greenback. When the week started, knowledge revealed that July’s US wholesale inflation was softer than anticipated.

-Are you curious about studying concerning the forex signals telegram group? Click on right here for details-

In the meantime, the headline CPI determine eased to 2.9% from 3.0%. Consequently, traders elevated the chance of a Fed fee reduce in September. Nevertheless, the greenback bought a short respite when retail gross sales jumped by 1.0%. However, Fed fee reduce expectations saved a lid on positive aspects.

Subsequent week’s key occasions for USD/CAD

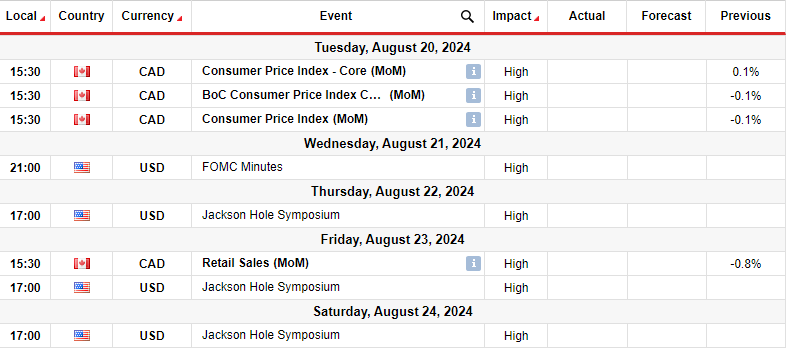

Subsequent week, merchants will take note of Canada’s inflation and retail gross sales knowledge. In the meantime, the US will launch the FOMC assembly minutes. On the similar time, traders pays shut consideration to Powell’s speeches on the Jackson Gap Symposium.

Canada’s CPI fell by 0.1% within the earlier month. Inflation within the nation has fallen in current months, giving policymakers confidence to chop rates of interest. On the similar time, Canada’s financial system has slowed down, particularly within the labor market.

Consequently, traders anticipate the Financial institution of Canada to chop charges in September. One other cooler inflation report will assist these expectations. In the meantime, the FOMC minutes may include clues on the Fed’s subsequent transfer. Moreover, Powell’s speeches will present whether or not the central financial institution is able to reduce in September.

USD/CAD weekly technical forecast: Bears meet the 1.3700 barrier

On the technical aspect, the USD/CAD value trades under the 22-SMA with the RSI under 50, indicating a bearish bias. The pattern not too long ago reversed when the worth reached the 1.3900 resistance degree. Bears took management by pushing the worth under the 30-SMA. Nevertheless, the decline has paused on the 1.3700 assist.

-If you’re taken with forex day trading then have a learn of our information to getting started-

Right here, bulls may resurface to retest the not too long ago damaged 22-SMA earlier than the downtrend continues. A break under the 1.3700 assist will enable bears to succeed in the 1.3601 degree. Furthermore, the worth would make a decrease low, confirming the downtrend. Alternatively, if the SMA fails to carry as resistance, the worth will climb to the 1.3900 resistance.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you’ll be able to afford to take the excessive danger of shedding your cash.