Altcoins took successful final week, resulting in a $40 billion decline within the international crypto market cap, which dropped to $2.09 trillion. This week’s trio of high cryptocurrencies are price watching within the coming days.

RARE secures 223% weekly achieve

SuperRare (RARE), the native token of the NFT marketplace, witnessed volatility final week.

The token began the week with a 34% surge earlier than dealing with a three-day decline from Aug. 12 to 14, dropping 18%.

Nonetheless, it rebounded on Aug. 15, triggering a surge in social quantity, in response to a disclosure from LunarCrush.

Amid a resurgence of curiosity, RARE sustained the run, spiking 127% in three days and shutting the week with a 223% achieve.

The token’s RSI now stands at 91.14, indicating an overbought situation. This means a doable upcoming correction. The CCI, at 374.45, additionally indicators huge overbought ranges, confirming these sentiments.

The newest run has helped RARE surpass the 0.236 Fibonacci stage, because it at the moment seems to maintain its place above $0.3. If RARE holds the 0.236 Fibonacci help, it might proceed upwards.

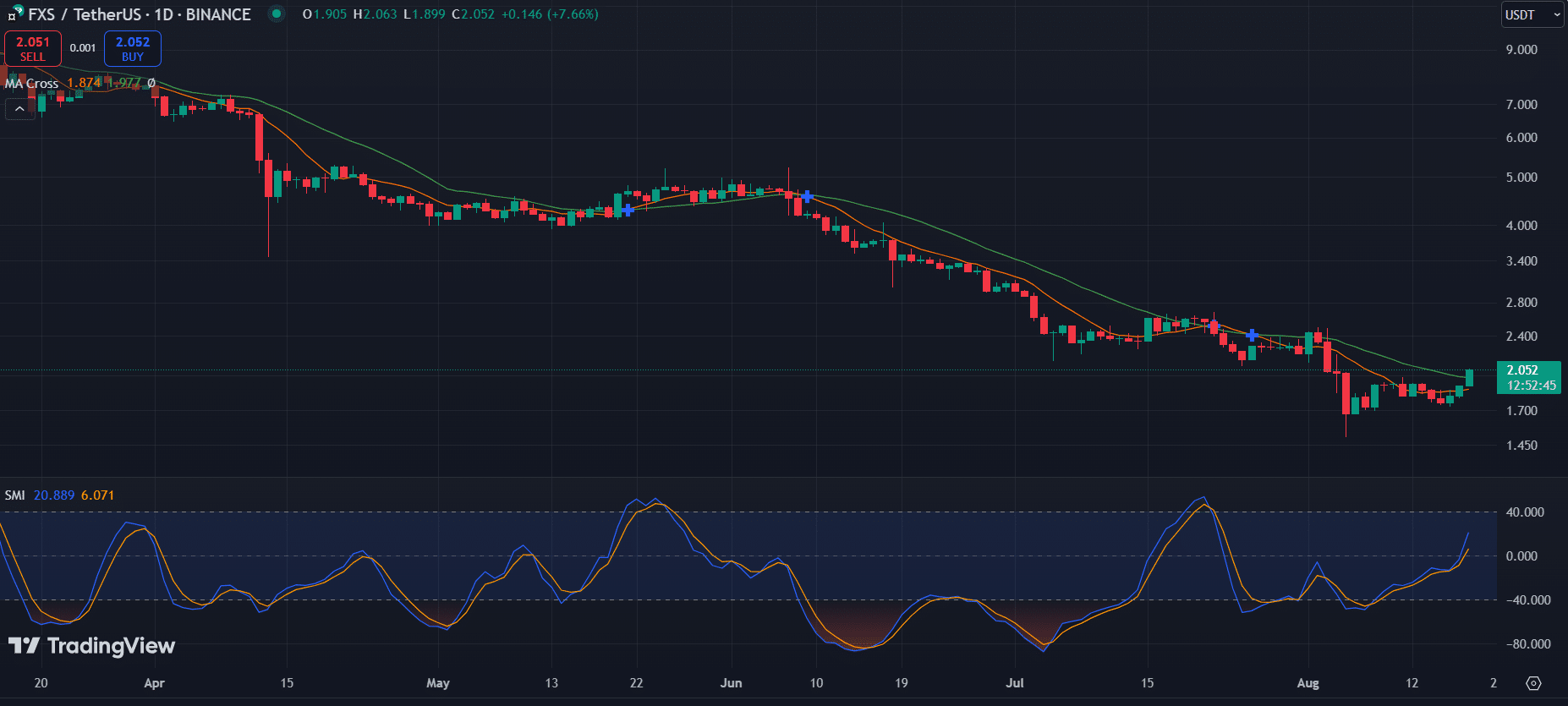

FXS maintains resilience

Frax Share (FXS) exhibited restricted volatility final week, closing at $1.906. This represented a meager 0.67% drop. This lackluster motion contrasted the primarily bearish trend within the broader market, suggesting a touch of resilience from FXS.

Nonetheless, Frax Share’s shifting averages point out bullish potential. The asset just lately crossed above the nine-day MA (orange line) as its short-term momentum flipped bullish.

Additionally, the nine-day MA seems to cross above the 21-day MA (inexperienced line). If this MA cross happens, it might recommend a bullish reversal on the horizon.

The Stochastic Momentum Index additionally helps this outlook. The SMI line (blue) has surged above the MA line (orange), indicating constructing bullish momentum. As each indicators align, FXS might be poised for an upward transfer. Nonetheless, affirmation within the coming days is important.

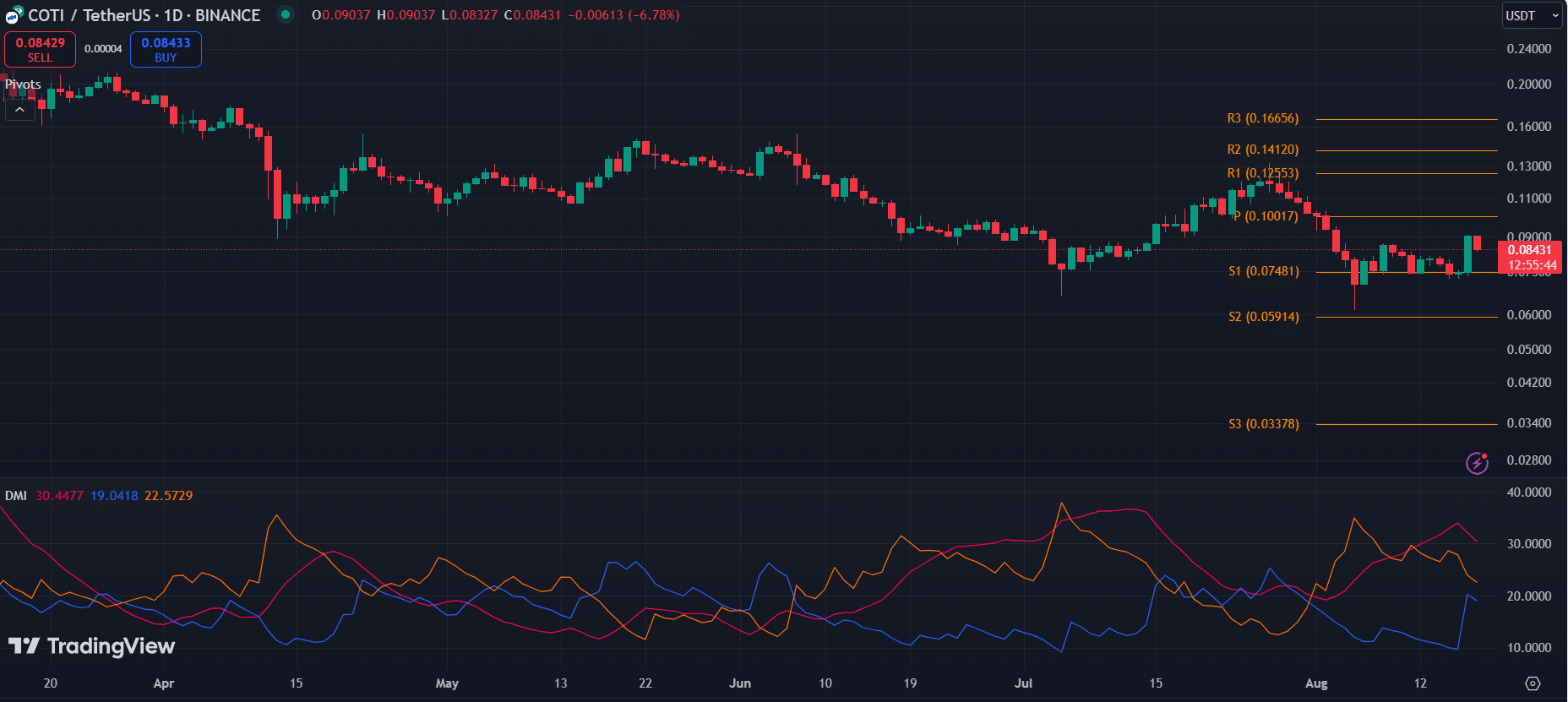

COTI faces blended sentiments

COTI was bearish all through final week, collapsing 14% from Aug. 11 to fifteen. Nonetheless, it recorded a 21% surge on Saturday to shut the week with a ten% enhance.

The asset has now been corrected because it encounters promoting stress.

The every day pivot factors present key resistance at $0.10017, $0.12553, and $0.14120. COTI’s quick help lies at $0.07481, representing S1.

A breakdown under S1 might push costs in the direction of S2 at $0.05914.

In the meantime, the Directional Shifting Index signifies bearish momentum. The ADX (purple line) is at 30.4, suggesting a powerful development, whereas the -DI (orange line) at 22.57 is above the +DI (blue line) at 19.04, confirming bearish stress.

COTI’s potential to carry above S1 is essential. Failure to take action might set off additional draw back, whereas breaking via the Pivot may supply an opportunity for a restoration rally.