We have been spared from summer time doldrums in monetary markets this yr however early subsequent week may very well be one thing of a dud, notably till Jackson Gap begins.

Monday kicks off with Fed’s Waller talking at 09:15 am ET however that will likely be all for the day.

Tuesday options speeches from the Fed’s Bostic and Barr however is in any other case naked.

Wednesday is hardly higher with solely EIA weekly crude oil shares and a 20-Yr bond public sale. The spotlight would be the FOMC Minutes launch at 14:00 pm ET; count on some dovish indicators there.

Thursday is when it picks up with jobless claims knowledge, S&P International PMIs (composite, companies, and manufacturing), and current residence gross sales. The consensus for Preliminary Jobless Claims is 229K whereas current residence gross sales are anticipated to point out a 0.4% decline. The Jackson Gap Symposium additionally begins, with further Fed interviews normally scheduled for the early US morning.

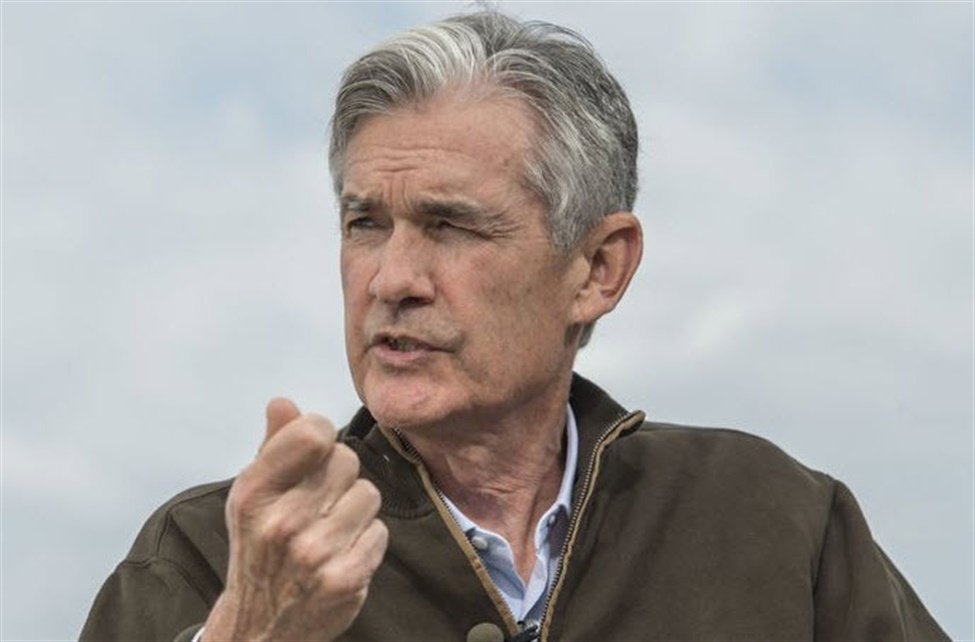

Friday closes the week with new residence gross sales knowledge, anticipated to point out a 0.6% decline to 0.63 million. The principle occasion will likely be Fed Chair Powell’s speech at 10:00 am ET from Jackson Gap however with Fed pricing at 75% for 25 bps, I do not at present see a must make any large waves. Baker Hughes US Oil Rig Rely and CFTC place knowledge spherical out the day.

The Jackson Gap Symposium continues by way of Saturday.

For extra, see the economic calendar.