- US providers sector PMI information confirmed growth.

- US jobless claims fell, indicating a still-tight labor market.

- The pound fell as markets contemplated the Financial institution of England’s first charge minimize.

The GBP/USD weekly forecast is barely bearish regardless of the current rally, because the Financial institution of England seems extra assured about reducing charges additional.

Ups and downs of GBP/USD

The pound had a bearish week however closed far above its lows. The pair began the week down as buyers dumped dangerous belongings amid fears of a US recession. Knowledge within the earlier week confirmed weaker-than-expected financial efficiency.

–Are you curious about studying extra about STP brokers? Examine our detailed guide-

Nevertheless, this modified with the US providers sector PMI information, which confirmed growth. In the meantime, jobless claims fell, indicating a still-tight labor market. However, buyers have been already pricing a extra vital 50 bps Fed charge minimize in September.

Moreover, the pound fell as markets contemplated the Financial institution of England’s first charge minimize.

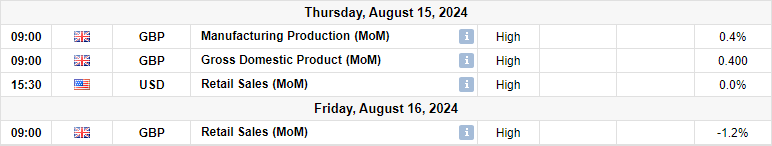

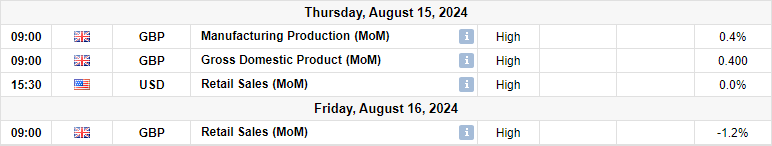

Subsequent week’s key occasions for GBP/USD

Subsequent week, the pound may expertise vital volatility resulting from US and UK inflation and retail gross sales information. Moreover, the UK will launch information on employment, GDP, and manufacturing manufacturing. Markets will give attention to the buyer inflation stories, shaping the outlook for financial coverage within the UK and the US.

The Fed is seeking to begin its rate-cutting cycle in September. Inflation within the US has been on a downtrend, and the financial system is starting to crack. Subsequently, additional easing inflation will give policymakers sufficient confidence to chop rates of interest.

In the meantime, the Financial institution of England lately applied its first charge minimize. Nevertheless, most policymakers consider underlying inflation stays excessive. Nonetheless, they’ve gained sufficient confidence to start out decreasing borrowing prices.

GBP/USD weekly technical forecast: Bears eying 1.2620 assist

On the technical aspect, the GBP/USD value trades beneath the 22-SMA with the RSI beneath 50. Subsequently, bears are in management. Nevertheless, the worth has made greater highs and lows on a bigger scale, indicating a bullish development.

–Are you curious about studying extra about making money with forex? Examine our detailed guide-

After puncturing the 1.2800 assist, bears are actually eyeing the 1.2620 stage. Initially, GBP/USD reached the next low at this stage. Subsequently, it’s a sturdy barrier. Nevertheless, if bears breach this stage, the worth will make a decrease low, breaking the bullish development sample. On this case, GBP/USD would verify a brand new bearish development. Alternatively, if the extent holds agency as assist, bulls may resurface to make a brand new excessive.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash.