- Traders elevated bets on a BoJ price hike subsequent week.

- US GDP figures for Q2 got here at 2.8%, properly above the two.0% forecast.

- Traders await the Financial institution of Japan and Fed coverage conferences.

The USD/JPY weekly forecast is bearish, with buyers more and more betting on a Financial institution of Japan price hike at subsequent week’s assembly.

Ups and downs of USD/JPY

The USD/JPY pair had a bearish week, the place the yen discovered its toes towards the greenback. The rally within the yen got here as buyers elevated bets on a BoJ price hike at subsequent week’s coverage assembly. The speed hike optimism stored the greenback at bay regardless of better-than-expected financial information.

–Are you curious about studying extra about Forex robots? Examine our detailed guide-

Notably, US enterprise exercise elevated in June because the providers sector expanded. In the meantime, GDP figures for Q2 got here in at 2.8%, properly above the two.0% forecast. Moreover, unemployment claims within the US fell final week, indicating a nonetheless strong labor market. Lastly, the core PCE index got here in keeping with expectations, rising by 0.2% m/m.

Subsequent week’s key occasions for USD/JPY

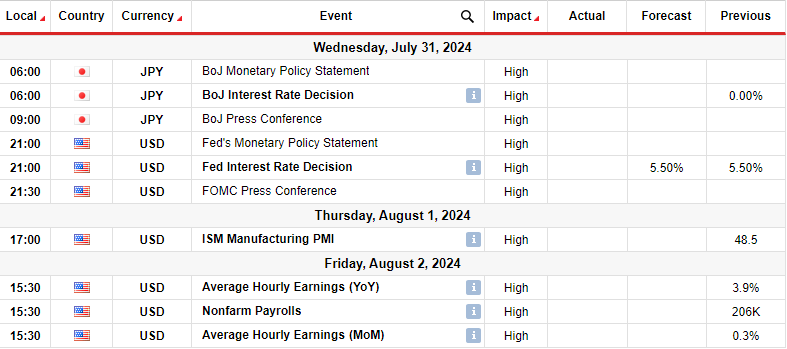

Subsequent week, USD/JPY will expertise lots of volatility with the Financial institution of Japan and Fed coverage conferences. On the identical time, the US will launch key manufacturing and employment information. Notably, there’s a 67.2% probability that the BoJ will hike charges by 10bps subsequent week. If this occurs, the yen would possibly strengthen, pushing USD/JPY decrease.

In the meantime, the Fed will seemingly maintain charges unchanged. Nonetheless, given the current decline in inflation, policymakers would possibly take a extra dovish stance.

Elsewhere, the US nonfarm employment report will proceed shaping the outlook for Fed price cuts. Easing within the labor market will give policymakers extra confidence to chop in September.

USD/JPY weekly technical forecast: Signaling a powerful downtrend

On the technical aspect, the USD/JPY value has damaged under its bullish trendline and is approaching the 152.01 help stage. Furthermore, the RSI has crossed under 50, indicating a bearish sentiment shift.

–Are you curious about studying extra about XRP price prediction? Examine our detailed guide-

The worth was in an uptrend with greater highs and lows for a very long time. Nonetheless, this modified when the value broke under the earlier low to make a decrease low. There’s a excessive probability it’ll additionally make a decrease excessive subsequent week. A downtrend would permit bears to retest the 152.01 and 146.50 help ranges.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive danger of shedding your cash.