- EUR/USD forecast is barely bullish after Fed’s cautiousness.

- Powell insisted that the central financial institution wants larger confidence to start out chopping rates of interest.

- Fabio Panetta mentioned the ECB can proceed to decrease borrowing prices.

The EUR/USD forecast is bullish because the greenback retreats after rising within the earlier session on account of Powell’s cautious remarks. In the meantime, ECB policymakers are calling for extra fee cuts which might put stress on additional features for the euro.

–Are you interested by studying extra about Bitcoin price prediction? Test our detailed guide-

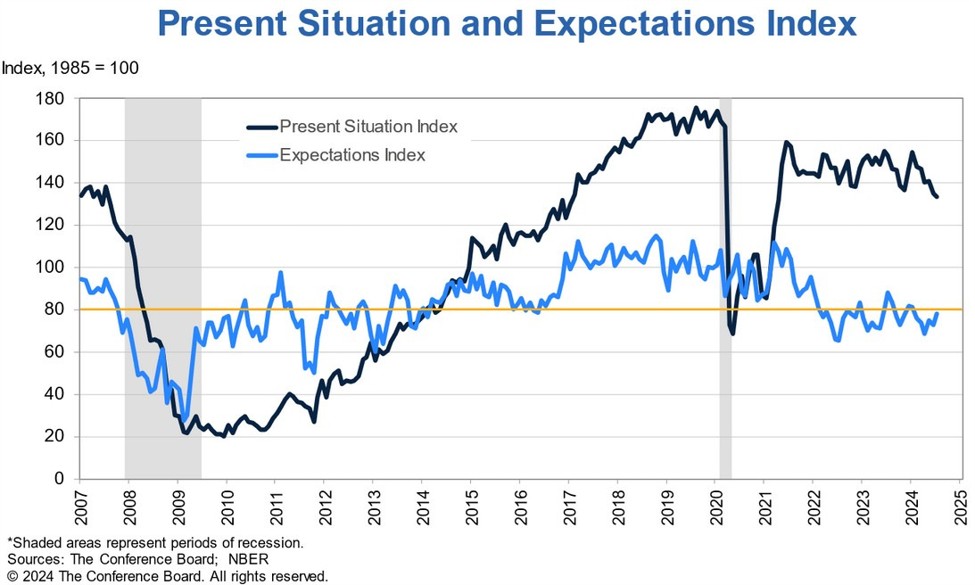

Markets perceived Powell’s speech on Tuesday as cautious. Nonetheless, there have been dovish tones which saved fee lower bets principally regular. The current jobs report raised market expectations that the Fed will lower charges in September. Subsequently, traders had anticipated an analogous response from the Fed.

Sadly, Powell insisted that the central financial institution wants larger confidence to start out chopping rates of interest. Policymakers have determined to attend till the final minute to name for fee cuts. The final time inflation confirmed indicators of easing, it reversed after most officers had assumed a dovish stance. Subsequently, they needed to shift their tone. To keep away from one other such consequence, the Fed will watch for extra knowledge to achieve confidence that inflation will fall to the two% goal.

The subsequent main report will come on Thursday. The US will launch shopper inflation numbers that would point out additional easing in worth pressures. Economists anticipate an easing within the annual determine to three.3%. In the meantime, the month-to-month determine would possibly enhance barely to 0.1%.

Elsewhere, ECB policymakers are calling for extra fee cuts as inflation nears the central financial institution’s goal. Fabio Panetta mentioned the ECB can proceed to decrease borrowing prices as inflation stays consistent with the central financial institution’s expectations. Furthermore, since rates of interest are nonetheless excessive, they’ll finally decrease the cussed companies inflation.

EUR/USD key occasions at this time

- Fed Chair Powell’s testimony

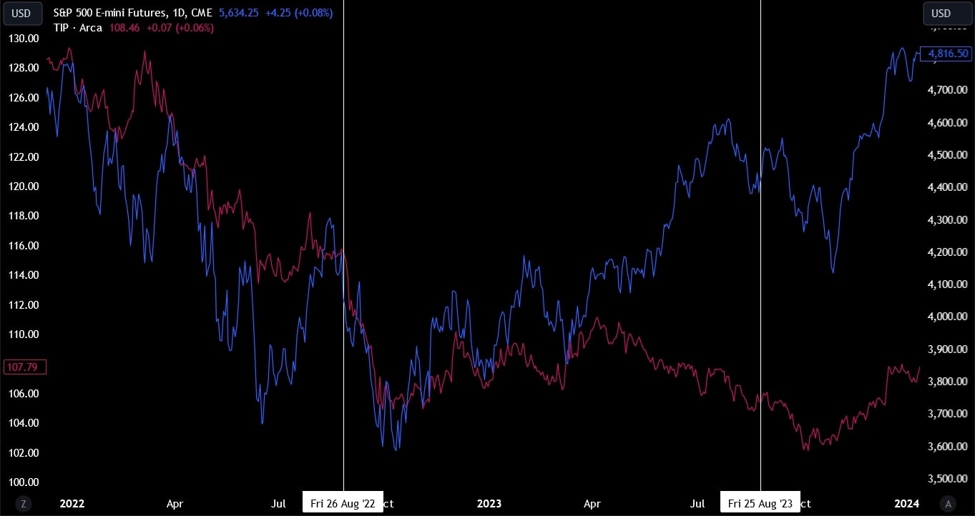

EUR/USD technical forecast: Value prepares to bounce greater after SMA retest

On the technical facet, the EUR/USD worth has discovered assist on the 30-SMA line and would possibly bounce greater. The pair has been on a bullish pattern because it discovered strong assist on the 1.0675 degree. An uptrend implies that the SMA acts as assist and the value bounces greater every time it retests the extent.

–Are you interested by studying extra about crypto robots? Test our detailed guide-

Subsequently, if the pattern continues to be sturdy, the value would possibly quickly problem the 1.0850 resistance for a brand new excessive. Nonetheless, if bears have gained momentum, the value will break beneath the SMA to retest assist ranges just like the trendline and the 1.0750 degree.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.